The New Student Loan System: How Screwed Are We? [UPDATED]

"The word bipartisan means some larger-than-usual deception is being carried out." — George Carlin

To great establishment fanfare, the Bipartisan Student Loan Certainty Act has now passed both Houses of Congress, and should be signed by President Obama shortly. [UPDATE 1: President Obama has signed the bill.] This new law changes the previous regime of fixed interest rates and allows them to float — to a certain degree.

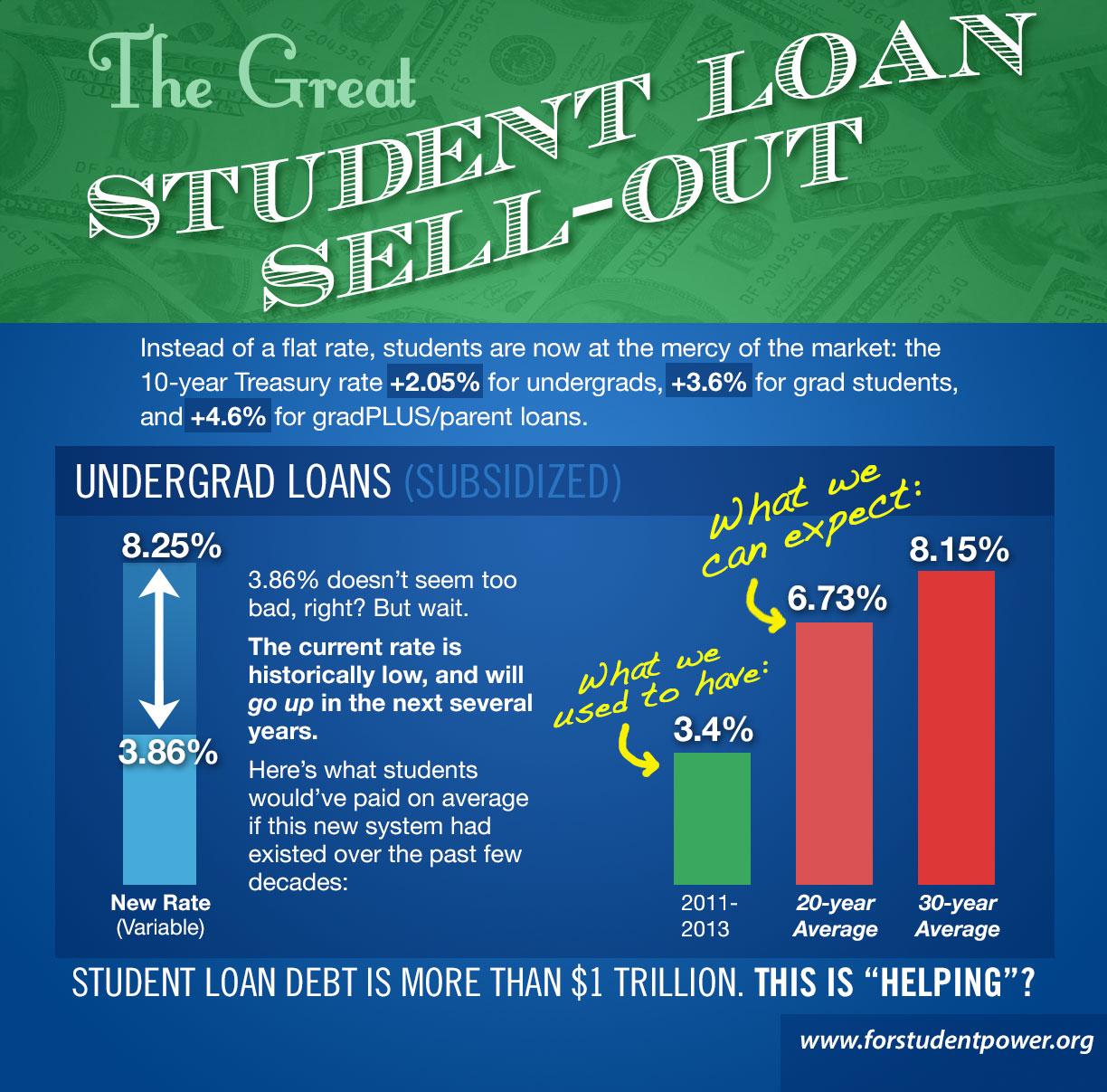

Now, the interest rate on your student loan will be set at whatever the 10-Year Treasury bill rate is, plus a fixed percentage. Here's the percentage breakdown, with the caps on how high the interest rate can get:

| Type of Loan | Previous Rate | New Rate | Cap |

| Undergrad Stafford subsidized | 3.4% (6.8% as of July 1) | T-bill + 2.05% | 8.25% |

| Undergrad Stafford unsubsidized | 6.8% | T-bill + 2.05% | 8.25% |

| Grad Stafford | 6.8% | T-bill + 3.6% | 9.5% |

| GradPLUS/Parent | 7.9% | T-bill + 4.6% | 10.5% |

You'll remember the great wailing and gnashing of teeth around the July 1 rate hike, particularly on the liberal/progressive side of the debate, when the 3.4% interest rate expired. It was a very similar to the wailing and gnashing of a year before, when the 3.4% rate was originally scheduled to expire. But because 2012 was an election year, we saw a very different outcome: both Obama and Romney came out in favor of extending the interest rate another year, and it passed both houses easily.

This year, without the pressures of a Presidential campaign, Congress let July 1 come and go without a fix. Given how malleable deadlines are with a legislative body that can pass laws with retroactive effect, as they did in this case, apocalyptic cut-off dates seem to have much more to do with public perception of lawmaking than with lawmaking itself.

Based on how low the T-bill rate is now, that means undergrads get a halfway decent deal this year: 3.86%, only slightly up from where it was before July 1st. However, there's a problem. The T-bill rate is not just low, it's historically, ludicrously low. The yearly average T-bill rate for the past two years has been so low that you'd have to go back to 1941 to find another that low. That means that the 3.86% rate will be gone very soon: according to rough CBO estimates, we could very likely see T-bill rates of 5.2% in 2017, which would bump up the interest rate of undergrad loans to a painful 7.4%.

While past results are no guarantee of future performance, it is the best benchmark we can go by. I've pulled together these stats, along with what the average student loan interest rate would have been over the past 20 and 30 years, had the new law been in effect then. The results aren't pretty (see the infographic below).

17 of the most reliably progressive and pro-student members of the Senate voted against the bill, along with 25 mostly progressive Democrats and 6 Republicans in the House. It makes one wonder why progressive student-oriented groups like Generation Progress (formerly Campus Progress) and Rock the Vote pushed so hard for the passage of a bill that 1) will make the student loan crisis worse, 2) will do nothing to help those straining under the $1.2 trillion in debt already out there, and 3) was hailed by Speaker Boehner as "almost identical" to what the House GOP wanted.

Perhaps it's because they're not democratically accountable to actual students? The United States Student Association's newly elected President, Sophia Zaman, has come out very publicly against it. [UPDATE 2: Kalwis Lo, Leg Director for USSA, co-penned a favorable statement about the bill's passing, in an apparent reversal of position. I imagine there's an interesting story behind this move.]

Some say that this is just a temporary stopgap, meant to help students now but will be fixed soon (some say as soon as this fall, when the Higher Education Act is up for renewal). Do we really need to remind these folks of the "pass it now, fix it later" slogan used to get progressives behind the Affordable Care Act? As Jon Walker put it:

Inertia is an overwhelming force in Washington. Things rarely get improved later even when politicians say improvement is needed. That is why it is so important to fight to get the design right to begin with, or we end of living with the design flaws for a very long time.